The rapid expansion of the Global Lithium-Ion Battery Electrolyte Market can be attributed to the surging requirement for energy storage devices, particularly within the automotive and consumer electronics industries. Lithium-ion battery electrolyte acts as a conductive material, allowing lithium ions to travel between the positive and negative terminals. The market benefits from ongoing developments in battery technology, increased adoption of electric cars, and rising demand for portable electronic devices. Moreover, the escalating environmental consciousness and emphasis on sustainable energy solutions are fueling highly advantageous prospects for the lithium-ion battery electrolyte market.

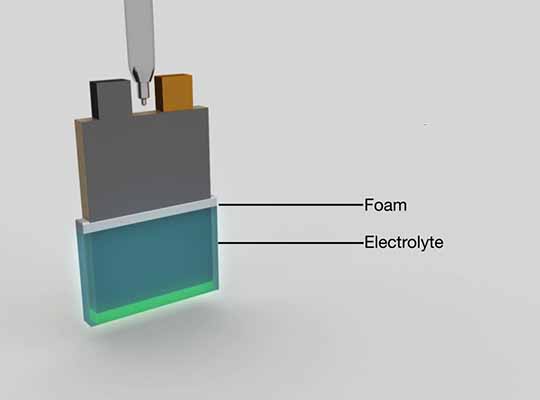

A lithium-ion battery’s electrolyte is a substance, either in liquid or gel form, that facilitates the movement of lithium ions between the positive and negative electrodes during charging and discharging. This electrolyte, composed of a combination of organic solvents and lithium salts, serves as a conductor for ion transportation and prevents direct contact between the electrodes to prevent internal short circuits. The specific composition of the electrolyte is essential for optimizing battery performance and ensuring safety, as it influences factors such as conductivity, stability, and thermal properties. Ongoing research is dedicated to enhancing the stability of the electrolyte, promoting safety, and enabling higher energy storage capacity in lithium-ion batteries.

The estimated value of the worldwide Lithium-Ion Battery Electrolyte market was approximately USD 1.83 billion in 2020. It is projected to exhibit a compound annual growth rate (CAGR) of 5.94% from 2021 to 2032, reaching an anticipated valuation of around USD 3.41 billion by 2032.

Extensive research has yielded an intriguing discovery regarding the global lithium-ion battery electrolyte market, highlighting the dominance of the Asia Pacific region. This supremacy can be attributed to several key factors, including a robust demand for electric vehicles, the presence of prominent battery manufacturers, and proactive government initiatives aimed at fostering the utilization of renewable energy sources. It is crucial to acknowledge that these findings are firmly grounded in meticulous market data research and analysis.

The utilization of liquid electrolyte is anticipated to have a significant presence in the prevailing Global Lithium-Ion Battery Electrolyte market. Solid electrolytes, which are often composed of ceramics or polymers, provide increased safety, stability, and energy density. Their solid-state nature minimizes the possibility of leakage and flammability associated with liquid electrolytes, solving safety issues while also promoting the development of high-performance lithium-ion batteries simultaneously in an efficient and effective way.

The Electric Vehicle sector emerges as the prominent within the Global Lithium Ion Battery Electrolyte market. The push for green transportation, along with government incentives for electric mobility, is driving up consumption of lithium-ion battery electrolytes in the EV industry.

- LG Chem and Panasonic recently formed a strategic partnership with the objective of advancing and manufacturing cutting-edge lithium-ion battery technology. The primary goal is to enhance battery performance while simultaneously reducing costs. This collaboration, announced on January 29, 2021, brings together the expertise and resources of both companies in an effort to drive innovation in the field of battery technology.

- Another significant development in the realm of lithium-ion batteries occurred on March 17, 2021, when SK Innovation unveiled its plans to invest a staggering $1.67 billion into the construction of a state-of-the-art lithium-ion battery factory in Georgia, USA. This massive undertaking aims to meet the growing demand for electric vehicle batteries and, concurrently, bolster the local economy by generating employment opportunities.

- Recognizing the rising importance of securing a stable supply of lithium, CATL- a leading Chinese manufacturer of lithium-ion batteries- made a strategic move on September 15, 2021. By acquiring an 8.5% stake in Pilbara Minerals, an Australian lithium miner, CATL ensures its access to this crucial component. This decision aligns with the escalating demand for electric vehicles and the subsequent need for lithium, underscoring CATL’s commitment to maintaining a sustainable and resilient supply chain.

Prominent entities shaping the landscape of the Lithium Ion Battery Electrolyte Market consist of Mitsubishi Chemical Corporation, UBE Industries Ltd., Shenzhen Capchem Technology Co Ltd, TOMY Co Ltd, BASF SE, KISHIDA CHEMICAL CO., LTD., Central Glass Co., Ltd., PANAX ETEC, TORAY INDUSTRIES, INC., and Soulbrain Holdings Co., Ltd. These industry leaders are deeply engaged in the exploration, innovation, and manufacture of cutting-edge electrolyte substances, aimed at enhancing the overall functionality of batteries.

To find out more, visit www.adroitmarketresearch.com