The “Electric Vehicle (EV) Sensor Global Market Report 2023” report has been added to ResearchAndMarkets.com‘s offering.

The global electric vehicle (EV) sensor market is expected to grow from $7.34 billion in 2022 to $8.35 billion in 2023 at a compound annual growth rate (CAGR) of 13.6%. The electric vehicle (EV) sensor market is expected to reach $13.38 billion in 2027 at a CAGR of 12.5%.

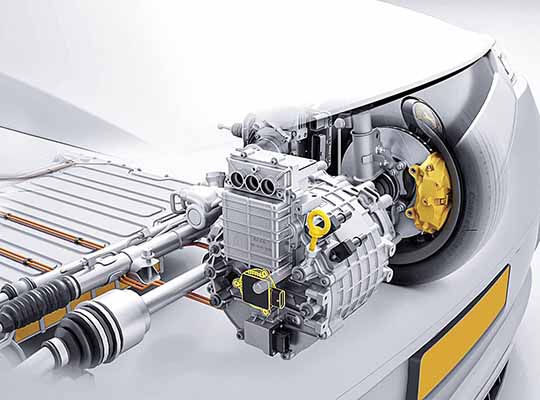

The increase in demand for electric vehicles is expected to propel the growth of the electronic vehicle (EV) sensors market. Electronic vehicles refer to vehicles that are either partially or fully powered by electric power. EV sensors are used in electric vehicles to read real-time signals and take necessary actions to manage in-vehicle functions such as ignition time, and speed control, assist in lowering gasoline prices, reduce carbon emissions, and enhance energy security.

For instance, according to May 2022 published, Global EV Outlook 2022 report, electric vehicle (EV) sales had doubled from the previous year in 2021, reaching a new high of 6.6 million. Additionally, the sales of electric car vehicles worldwide in 2021 have reached 6600000 units from 2980000 units. Therefore, The increase in demand for electric vehicles is driving the growth of the electronic vehicle (EV) sensors market.

Product innovations are a key trend gaining popularity in the EV sensors market. Major market players are developing innovative technologies through extensive research and development activities to strengthen their business position. For instance, in May 2022, Continental, a Germany-based automobile company, introduced the current Sensor Module (CSM) and the battery impact detection (BID) system for electrified vehicles, expanding its already extensive sensor range.

The two new sensors will significantly emphasize battery characteristics or battery safety. Furthermore, in June 2022, Microchip Technology Inc, a US-based semiconductor manufacturer, introduced The LX34070 IC, a new inductive position sensor for the electric vehicle motor control industry. The sensor has differential outputs, quick sample rates, and other features that enable it to comply with ISO 26262 at Automotive Safety Integrity Level-C (ASIL-C) level.

In January 2023, Sona BLW Precision Forgings, an India-based precision forging technology company, acquired a 54% equity stake in NOVELIC, the sensors and software company from Sweden, for 40.5 million euros ($43.59 million). Sona Comstar is expected to enter the ADAS sensor industry with this acquisition. NOVELIC is a Serbia-based self-sustaining provider of mmWave radar sensors operating in the electronic vehicle (EV) sensors market.

North America was the largest region in the electric vehicle (EV) sensor market in 2022. The regions covered in electronic vehicle (EV) sensors report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the coronavirus and how it is responding as the impact of the virus abates.

- Assess the Russia – Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

Description:

Where is the largest and fastest growing market for electric vehicle (ev) sensor? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The electric vehicle (ev) sensor market global report answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of covid 19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product Type: Temperature Sensors; Current Sensors; Position Sensors; Pressure Sensors; Speed Sensors

2) By Propulsion: Battery Electric Vehicles (BEVs); Hybrid Electric Vehicles (HEVs); Plug-In Hybrid Electric Vehicles (PHEVs)

3) By Sales Channel: OEM (Original Equipment Manufacturer); Aftermarket

Key Topics Covered:

1. Executive Summary

2. Electric Vehicle (EV) Sensor Market Characteristics

3. Electric Vehicle (EV) Sensor Market Trends And Strategies

4. Electric Vehicle (EV) Sensor Market – Macro Economic Scenario

5. Electric Vehicle (EV) Sensor Market Size And Growth

6. Electric Vehicle (EV) Sensor Market Segmentation

7. Electric Vehicle (EV) Sensor Market Regional And Country Analysis

7.1. Global Electric Vehicle (EV) Sensor Market, Split By Region, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

7.2. Global Electric Vehicle (EV) Sensor Market, Split By Country, Historic and Forecast, 2017-2022, 2022-2027F, 2032F, $ Billion

A selection of companies mentioned in this report includes

- Denso

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- LEM

- Kohshin Electric Corporation

- Vishay Intertechnology Inc.

- Allegro MicroSystems Inc.

- Amphenol Advanced Sensors

- ams-OSRAM AG

- Analog Devices Inc.

- Melexis

- Sensata Technologies Inc.

- STMicroelectronics N.V.

- Renesas Electronics Corporation

- TE Connectivity