The “Electric Vehicle (EV) Battery Housing Market – A Global and Regional Analysis: Focus on Battery Housing Vehicle Type, Cell Format, Battery Chemistry, Materials, and Country Analysis – Analysis and Forecast, 2022-2031” report has been added to ResearchAndMarkets.com‘s offering.

The global electric vehicle battery housing market is projected to reach $11,749.9 million by 2031 from $3,678.2 million in 2021, growing at a CAGR of 12.43% during the forecast period 2022-2031.

The growth in the global electric vehicle battery housing market is expected to be driven by rising demand for electric vehicles and evolution of lithium-ion batteries. Also, the rising focus on vehicle weight reduction by using lightweight materials is helping the electric vehicle battery housing market grow considerably.

Market Lifecycle Stage

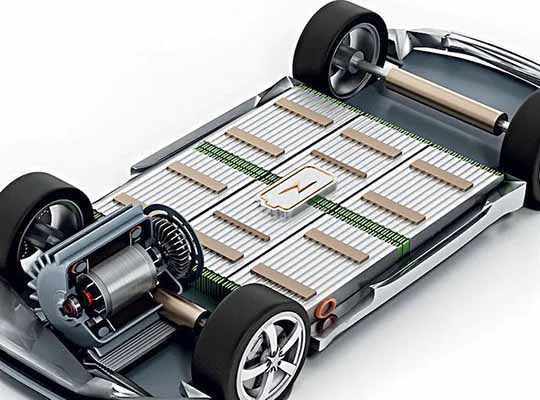

Battery protection and monitoring are a necessity with Li-ion battery packs to protect it from overvoltage and load impact during crash/accidents. To avoid damages by side-impact and pole impact load cases, the EVs are equipped with battery housing systems.

The battery enclosure of an EV is responsible for providing crash-safe battery protection against electric shock and fire dangers. The growth of the global electric vehicle battery housing market is majorly attributed to the growing inclination toward vehicle weight reduction by using lightweight materials.

Increasing EV range and battery capacity coupled with demand for robust vehicle design is benefitting the market growth. Additionally, electric vehicle battery housing players have tended toward new product launches to expand their innovative capabilities.

Furthermore, favorable government policies supporting the adoption of electric vehicles across the globe, advancements in housing material, and increase in competition in the electric vehicle are projected to offer new avenues for the electric vehicle battery housing market. There are some challenges in the market, such as solid-state batteries and challenges associated with lack of standardization of electric vehicle battery. The ongoing vital developments in the market are expected to overcome them in the forecast period.

Impact of Electric Vehicle Battery Housing Market

- With the rapidly evolving electric vehicle market, the battery housing used in electric vehicles are responsible for providing crash-safe battery protection against electric shock and fire dangers.

- The development of innovative materials and material compositions for battery housing has greatly enhanced the design and structure of EV battery packs. Major battery housing producers such as Novelis Inc., Magna International, Nemak etc. are working on the development of new products that meet the current and future battery housing requirements of electric vehicle battery producers.

- EV manufacturers are developing battery housing systems that can provide high yield strength, high fatigue strength, sealing, heat management, anti-vibration, and corrosion protection to their battery packs.

Impact of COVID-19

The impact of COVID-19 on the electric vehicle Battery housing industry has been moderately affected as compared to the impact on the general automotive industry. Furthermore, due to variables like the increasing demand and annual sales of electric cars, there is a considerable increase in the need for electric vehicle battery and components.

Additionally, Companies working on steel and aluminum battery enclosures faced a surge in metal prices due to a sudden disruption in the supply chain. COVID-19 has had an aggressive impact on battery manufacturers, as it consumes lithium, nickel, and cobalt in precursor production. As a result, the prices for raw materials in the manufacture of batteries and housing have risen exponentially.

Recent Developments in Global Electric Vehicle Battery Housing Market

- In March 2022, in order to accommodate new business from Ford Motor Company for the provision of novel battery enclosures, Magna stated that it is extending its operations into Chatham as an expansion of its present facilities in St. Thomas.

- In June 2022, Renault Group, a prominent participant in the automotive industry, and Minth Group announced the signing of a memorandum of understanding to establish a joint venture in France to manufacture battery casings. In 2023, the joint venture will open two additional manufacturing lines in Ruitz, with a capacity of 300,000 battery casings per year by 2025, for electric vehicles such as the upcoming R5.

- In February 2022, Nemak, S.A.B. de C.V. said that it has been granted a contract worth US$350 million per year to manufacture battery housings for worldwide clients’ fully electric automobiles. Nemak intends to invest roughly $200 million in three new manufacturing locations across Europe and North America to support joining and assembly requirements for these products.

- In February 2021, CSP, along with its parent company Teijin introduced a patent-pending clip system that replaces the need for bolts in the process of joining the top and bottom of an electric vehicle battery case. This clip system improves the seal, reduces assembly costs, and makes the batteries easier to service when needed. The clips will be manufactured at CSP Stamping in Manchester, Michigan.

- In December 2020, CSP and its parent company Teijin introduced a new innovative honeycomb class A panel technology and an advanced, multi-material EV battery enclosure for electric vehicles.

- In April 2020, the company collaborated with BMW Group to manufacture battery enclosures made of fiber-reinforced plastics for the BMW i3 and BMW 7 series.

Demand – Drivers and Limitations

The following are the demand drivers for the global electric vehicle battery housing market:

- Increasing Demand for EVs Globally

- Rising Concern Toward the Environment

- Increasing Government Support

- Growing Need for Green Construction Machinery

- Growing EV Battery Production and Robust Design Requirements

- Continuously Declining Price of Li-Ion Battery

The following are the challenges for the global electric vehicle battery housing market:

- Solid-State Batteries

- Lack of Standardization

- Development of Electric Roads

- Underdeveloped Value Chain for Raw Materials in Developing Countries

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some prominent names established in this market are:

- SGL Carbon

- Novelis Inc.

- Nemak, S.A.B. de C.V.

- Constellium SE

- Gestamp Automocion, S.A.

- UACJ Corporation

- GF Linamar LLC

- Hanwha Solutions Advanced Materials

- Minth Group

- Continental Structural Plastics (CSP)

- ThyssenKrupp AG

- TRB Lightweight

- Hitachi Metals, Ltd.

- Norsk Hydro ASA

- Magna International Inc.