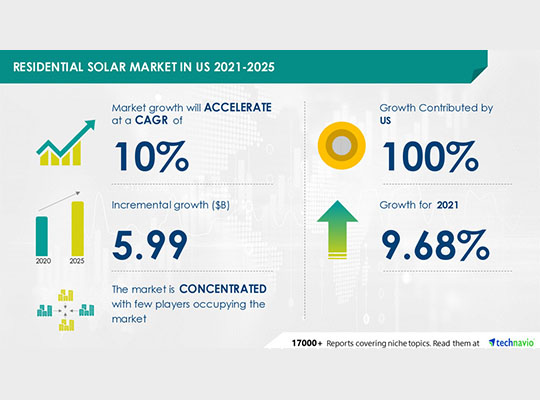

NEW YORK- The residential solar market in the US is concentrated. Vendors are deploying growth strategies such as developing new technologies to compete in the market. The market size is expected to grow by USD 5.99 bn from 2020 to 2025. In addition, the growth momentum of the market will accelerate at a CAGR of 10% during the forecast period, according to Technavio.

Get a comprehensive report summary describing the market size and forecast along

with research methodology. View our Sample Report

Residential Solar Market in US 2021-2025: Scope

The residential solar market in US report covers the following areas:

- Residential Solar Market in US size

- Residential Solar Market in US trends

- Residential Solar Market in US industry analysis

Residential Solar Market in US 2021-2025 : Segmentation

Residential Solar Market in the US is segmented as below:

- Technology

- Crystalline Silicon: This segment will contribute the highest market share growth during the forecast period. Crystalline silicon PV systems are widely used in the US.

- Thin-film

Learn about the contribution of each segment summarized in concise infographics

and thorough descriptions. View a Sample Report

Residential Solar Market in US 2021-2025: Vendor Analysis

The residential solar market in the US is highly diverse and has many international and domestic vendors. The vendors in the market are characterized by high capital investments. The vendors in the market include producers of solar PV modules, solar inverters, solar batteries, and other BOS (Balance of System). There is intense competition among vendors to increase their market shares.

Technavio provides a detailed analysis of around 25 vendors operating in the residential solar market in US, including Hanwha Group, LG Electronics Inc., Panasonic Corp., Sungevity Inc., Sunnova Energy International Inc., SunPower Corp., Sunrun Inc., Tesla Inc., Trina Solar Co. Ltd., and Trinity Heating & Air Inc. among others. The key offerings of some of these vendors are listed below:

- Hanwha Group – The company offers solar panels for commercial and residential comprehensive energy solutions.

- LG Electronics Inc. – The company offers solar panels for homes. It offers products like NeON R Series Solar Panels and other products for commercial and residential applications.

- Panasonic Corp. – The company offers solar modules like EverVolt Black Series solar modules, N330E HIT Black Series AC module, and other products for residential usage.

- Sungevity Inc. – The company provides solar panels, appliances, inverters, and other associated products and services for residential usage.

- Sunnova Energy International Inc. – The company offers a variety of solar energy solutions for residential usage.

Get lifetime access to our Technavio Insights. Subscribe to our “Basic Plan” billed

annually at USD 5000.

Residential Solar Market in US 2021-2025: Key Highlights

- CAGR of the market during the forecast period 2021-2025

- Detailed information on factors that will assist residential solar market growth in the US during the next five years

- Estimation of the residential solar market size in the US and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the residential solar market in the US

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of residential solar market vendors in the US

Related Reports:

Solar PV Market in APAC by End-user and Geography – Forecast and Analysis 2022-2026

Solar Central Inverters Market by Application and Geography – Forecast and Analysis 2022-2026

| Residential Solar Market In US Scope | |

| Report Coverage | Details |

| Page number | 120 |

| Base year | 2020 |

| Forecast period | 2021-2025 |

| Growth momentum & CAGR | Accelerate at a CAGR of 10% |

| Market growth 2021-2025 | USD 5.99 billion |

| Market structure | Concentrated |

| YoY growth (%) | 9.68 |

| Regional analysis | US |

| Performing market contribution | US at 100% |

| Key consumer countries | US |

| Competitive landscape | Leading companies, competitive strategies, consumer engagement scope |

| Companies profiled | Hanwha Group, LG Electronics Inc., Panasonic Corp., Sungevity Inc., Sunnova Energy International Inc., SunPower Corp., Sunrun Inc., Tesla Inc., Trina Solar Co. Ltd., and Trinity Heating & Air Inc. |

| Market Dynamics | Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID 19 impact and future consumer dynamics, market condition analysis for the forecast period, |

| Customization purview | If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Table Of Contents :

1. Executive Summary

2. Market Landscape

2.1 Market ecosystem

Exhibit 01: Parent market

2.2 Market characteristics

Exhibit 02: Market Characteristics

2.3 Value chain analysis

Exhibit 03: Value chain analysis: Utilities market

2.3.1 Electricity generation

2.3.2 Electricity transmission

2.3.3 Electricity distribution

2.3.4 End-customers

2.3.5 Industry innovations

3. Market Sizing

3.1 Market definition

Exhibit 04: Offerings of vendors included in the market definition

3.2 Market segment analysis

Exhibit 05: Market segments

3.3 Market size 2020

3.4 Market outlook: Forecast for 2020 – 2025

3.4.1 Estimating growth rates for emerging and high-growth markets

3.4.2 Estimating growth rates for mature markets

Exhibit 06: US – Market size and forecast 2020 – 2025 ($ million)

Exhibit 07: US market: Year-over-year growth 2020 – 2025 (%)

4. Five Forces Analysis

4.1 Five forces summary

Exhibit 08: Five forces analysis 2020 & 2025

4.2 Bargaining power of buyers

Exhibit 09: Bargaining power of buyers

4.3 Bargaining power of suppliers

Exhibit 10: Bargaining power of suppliers

4.4 Threat of new entrants

Exhibit 11: Threat of new entrants

4.5 Threat of substitutes

Exhibit 12: Threat of substitutes

4.6 Threat of rivalry

Exhibit 13: Threat of rivalry

4.7 Market condition

Exhibit 14: Market condition – Five forces 2020

5. Market Segmentation by Technology

5.1 Market segments

The segments covered in this chapter are:

- Crystalline silicon

- Thin-film

Exhibit 15: Technology – Market share 2020-2025 (%)

5.2 Comparison by Technology

Exhibit 16: Comparison by Technology

5.3 Crystalline silicon – Market size and forecast 2020-2025

Exhibit 17: Crystalline silicon – Market size and forecast 2020-2025 ($ million)

Exhibit 18: Crystalline silicon – Year-over-year growth 2020-2025 (%)

5.4 Thin-film – Market size and forecast 2020-2025

Exhibit 19: Thin-film – Market size and forecast 2020-2025 ($ million)

Exhibit 20: Thin-film – Year-over-year growth 2020-2025 (%)

5.5 Market opportunity by Technology

Exhibit 21: Market opportunity by Technology

6. Customer landscape

Technavio’s customer landscape matrix compares Drivers of price sensitivity, Adoption lifecycle, importance in customer price basket, Adoption rates and Key purchase criteria

Exhibit 22: Customer landscape

8. Drivers, Challenges, and Trends

8.1 Market drivers

7.1.1 Increasing investments in renewable energy

7.1.2 Favorable government regulations

7.1.3 Rising number of solar PV installations

8.2 Market challenges

7.2.1 Availability of alternative technologies

7.2.2 Technical challenges associated with battery technology

7.2.3 Low efficiency of solar PV

Exhibit 23: Impact of drivers and challenges

7.3 Market trends

7.3.1 Residential energy storage as virtual power plants

7.3.2 Market attracting new vendors

7.3.3 Increased green construction spending and zero energy homes

8. Vendor Landscape

8.1 Competitive scenario

8.3 Landscape disruption

The potential for the disruption of the market landscape was moderate in 2020, and its threat is expected to remain unchanged by 2025.

Exhibit 25: Landscape disruption

8.4 Industry risks

Exhibit 26: Industry risks

9. Vendor Analysis

9.1 Vendors covered

Exhibit 27: Vendors covered

9.2 Market positioning of vendors

Exhibit 28: Market positioning of vendors

9.3 Hanwha Group

Exhibit 29: Hanwha Group – Overview

Exhibit 30: Hanwha Group – Product and service

Exhibit 31: Hanwha Group – Key offerings

9.4 LG Electronics Inc.

Exhibit 32: LG Electronics Inc. – Overview

Exhibit 33: LG Electronics Inc. – Business segments

Exhibit 34: LG Electronics Inc. – Key offerings

Exhibit 35: LG Electronics Inc. – Segment focus

9.5 Panasonic Corp.

Exhibit 36: Panasonic Corp. – Overview

Exhibit 37: Panasonic Corp. – Business segments

Exhibit 38: Panasonic Corp.-Key news

Exhibit 39: Panasonic Corp. – Key offerings

Exhibit 40: Panasonic Corp. – Segment focus

9.6 Sungevity Inc.

Exhibit 41: Sungevity Inc. – Overview

Exhibit 42: Sungevity Inc. – Product and service

Exhibit 43: Sungevity Inc. – Key offerings

9.7 Sunnova Energy International Inc.

Exhibit 44: Sunnova Energy International Inc. – Overview

Exhibit 45: Sunnova Energy International Inc. – Business segments

Exhibit 46: Sunnova Energy International Inc. – Key offerings

9.8 SunPower Corp.

Exhibit 47: SunPower Corp. – Overview

Exhibit 48: SunPower Corp. – Product and service

Exhibit 49: SunPower Corp. – Key offerings

9.9 Sunrun Inc.

Exhibit 50: Sunrun Inc. – Overview

Exhibit 51: Sunrun Inc. – Business segments

Exhibit 52: Sunrun Inc. – Key offerings

Exhibit 53: Sunrun Inc. – Segment focus

9.10 Tesla Inc.

Exhibit 54: Tesla Inc. – Overview

Exhibit 55: Tesla Inc. – Business segments

Exhibit 56: Tesla Inc. – Key news

Exhibit 57: Tesla Inc. – Key offerings

Exhibit 58: Tesla Inc. – Segment focus

9.11 Trina Solar Co. Ltd.

Exhibit 59: Trina Solar Co. Ltd. – Overview

Exhibit 60: Trina Solar Co. Ltd. – Product and service

Exhibit 61: Trina Solar Co. Ltd. – Key offerings

9.12 Trinity Heating & Air Inc.

Exhibit 62: Trinity Heating & Air Inc. – Overview

Exhibit 63: Trinity Heating & Air Inc. – Product and service

Exhibit 64: Trinity Heating & Air Inc. – Key offerings

11. Appendix

10.1 Scope of the report

10.1.1 Market definition

10.1.2 Objectives

10.1.3 Notes and caveats

10.2 Currency conversion rates for US$

Exhibit 65: Currency conversion rates for US$

10.3 Research methodology

Exhibit 66: Research Methodology

Exhibit 67: Validation techniques employed for market sizing

Exhibit 68: Information sources

10.4 List of abbreviations

Exhibit 69: List of abbreviations