SAN FRANCISCO — The global fuel cells in aerospace market size is expected to reach USD 1,618.33 million by 2028, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 30.6% from 2021 to 2028. Growing awareness regarding alternative sources of energy is one of the major factors contributing to the growth of the market.

Key Insights & Findings from the report:

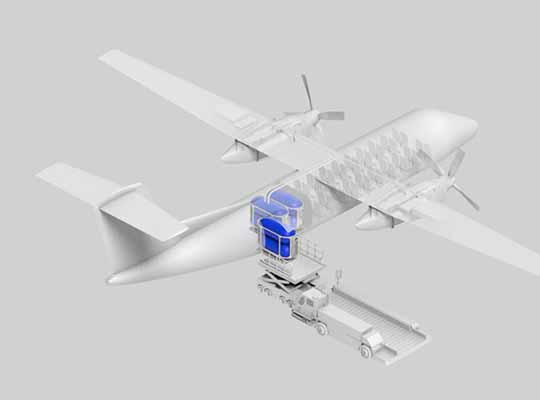

- In the aerospace industry, the PEMFC product segment accounted for the largest revenue share of over 85.0% in 2020. In the defense industry, PEMFC is used in various applications such as military vehicles and military drones

- In the defense industry, the military vehicles application segment accounted for the largest revenue share of over 50.0% in 2020. Vendors operating in the military vehicles market are partnering with fuel cell technology providers to launch fuel cell-based military ground vehicles

- In August 2020, the U.S. Department of Energy (DOE) announced to invest USD 18.5 million as part of the Advanced Research Projects Agency-Energy’s (ARPA-E) Range Extenders for Electric Aviation with Low Carbon and High Efficiency (REEACH) program. The team is developing a highly efficient and cost-effective hybrid-electric turbogenerator suitable for powering a narrow-body aircraft like B737

- Zero-emission-powered fuel cells deliver high efficiency and are more reliable in the case of long-distance flights and military surveillance. Thus, increasing aerospace and defense spending provides an opportunity for fuel cell technology to evolve and penetrate the market

The North American market for fuel cells in aerospace and defense is driven by significant support from the federal government of the countries. The U.K. is the leading country for fuel cells in aerospace and defense in the European region. Rising military spending in the APAC region has augmented the demand for military defense/UAVs and military vehicles. This, in turn, is anticipated to lead to the demand for fuel cells used in defense applications.

The market is likely to witness strategic alliances among businesses to expand their end-user segments in emerging markets. Public-private partnerships are predicted to be critical for attaining an economically viable technological shift. The introduction of cleaner technologies to substitute the existing methodologies is anticipated to lead to high costs, which is projected to limit innovations carried out by key market players.

The global fuel cell market is highly competitive owing to continuous technological advancements being introduced by the existing vendors and new entrants. Industry players are focusing on strengthening their relations with system installers and are looking at collaborations and mergers as strategies to help them enhance their presence in the value chain and expand their geographical presence.

Installers and system providers usually hold stock of major equipment in inventories. However, manufacturers faced bottlenecks and shortages owing to limited production in countries severely affected by the COVID-19. Furthermore, upcoming fuel cell-based large-scale projects witnessed delays in commissioning due to disruptions in the supply chain and halting of onsite construction activities in severely affected areas.

Market Segmentation:

Grand View Research has segmented the global fuel cells in aerospace and defense market based on aerospace (product & application), defense (product & application), and region:

- Fuel Cells in Aerospace and Defense Product Outlook (Aerospace) (Revenue, USD Million, 2017 – 2028)

- PEMFC

- SOFC

- Fuel Cells in Aerospace and Defense Product Outlook (Defense) (Revenue, USD Million, 2017 – 2028)

- PEMFC

- SOFC

- Fuel Cells in Aerospace and Defense Application Outlook (Aerospace) (Revenue, USD Million, 2017 – 2028)

- Commercial Aircrafts

- Rotorcrafts

- Fuel Cells in Aerospace and Defense Application Outlook (Defense) (Revenue, USD Million, 2017 – 2028)

- Military Drones/UAV

- Military Vehicles

- Fuel Cells in Aerospace and Defense Regional Outlook (Revenue, USD Million, 2017 – 2028)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- U.K.

- Spain

- Italy

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Central & South America

- Brazil

- Middle East & Africa

- UAE

- South Africa

- North America

List of Key Players of Fuel Cells In Aerospace And Defense Market

- Advent Technologies

- Australian Fuel Cells Pty Ltd.

- Cummins Inc.

- ElringKlinger AG

- GenCell Ltd.

- Honeywell International Inc.

- Infinity Fuel Cell and Hydrogen, Inc.

- Intelligent Energy Limited

- Loop Energy Inc.

- Plug Power, Inc.