NEW YORK — Analysts at S&P Global Platts, the leading independent provider of information, analysis and benchmark prices for the commodities and energy markets, announced their Top Energy Transition Trends to Watch in 2022, noting that key developments this year will provide insight into the momentum of the energy transition and the degree of public support.

Anne Robba, Manager of Future Energy Signposts, S&P Global Platts, said: “We’ll be watching closely to see if the public still has a strong appetite to ‘go electric’ in transportation in 2022. For example, electric vehicles (EVs) well weathered supply chain issues last year and saw record sales in 2021, but total light duty car sales declined. Elsewhere, 2022 could be a big year for low-carbon hydrogen production facilities and S&P Global Platts Analytics will be watching to see to what degree announced projects turn into operating facilities.”

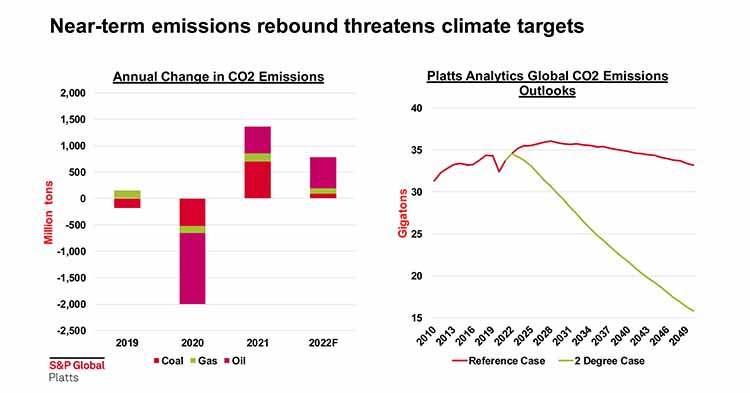

The conundrum: As global economies continue to grow, energy demand is outpacing the clean energy supply, requiring more fossil fuels use, which means more greenhouse gas emissions. According to S&P Global Platts Analytics, 2022 will be a record year for C02 emissions despite the Covid-19 pandemic and the world’s energy transition efforts. The graphic well shows much more is required if the world is to meet carbon emissions goals.

Key Energy Transition Trends to Watch in 2022

CO2 Emissions to Hit Record High in 2022 Despite Greater Focus on Climate; Emissions Policy is on the Ballot in Key Markets

Despite the focus on emissions reductions and a lengthening list of countries that have made net zero targets, S&P Global Platts Analytics expects that CO2 emissions from energy combustion will increase by 2.5% in 2022 to new record levels, as some economies recover more fully while others push for growth. While leaders at COP26 pledged to strengthen 2030 emissions targets by the end of 2022 rather than waiting for the formal “stock taking” process, there are significant risks to domestic environmental policy agendas from elections in 2022. During COP26 100 countries (with some notable exceptions) committed to 30% reduction in methane emissions by 2030, which will likely bolster interest in better understanding fossil fuels and their associated upstream carbon intensities. Record high carbon prices in the UK and Europe have triggered market intervention reviews. Midterm elections in the US have the potential to affect significantly the Biden Administration’s environmental agenda. In Australia, focus is on the opposition party and whether a prioritization of more aggressive environmental targets will win political and popular support. Such elections are reminders that “all politics are local” and the fate of global agreements often is determined by domestic elections, local public sentiment, and local policy shifts.

Strong Power Prices Boost Incentives for Renewables Installations, but Can They Deliver? Input Costs and Policy Risks Still Loom

Strong power prices have pushed renewable power margins to historically high levels across major markets and boosted prospects for faster installation growth in 2022. The irony here is that the underperformance of renewables was a key factor behind the surge in global gas and power prices in the first place. Despite an ~10% increase in commissioning costs due to historically high raw materials prices and labor issues, solar PV capacity additions are set to increase by 4% in 2022, while onshore wind installations increase by 1%, according to S&P Global Platts Analytics. However, the forecast calls for capacity growth declines for offshore wind, which will contract by 25% in 2022 after a strong 2021 due to China’s phase-out of subsidies. S&P Global Platts Analytics sees the need for policies that better balance the need to add zero-carbon electricity supply with the cost of the dispatchability/availability of oftentimes-intermittent renewable power. There are risks that renewables uptake will be increasingly associated with energy shortfalls and resulting high prices. The question will be how policymakers view the tradeoff between prioritization of energy transition or reliable supply.

Carmakers’ shifting preference for EVs to become more apparent; Light Duty EV sales to a new record high of over 9 million in 2022

The automotive sector struggled with supply chain issues in 2021, primarily a shortage of semiconductor chips, a key element in electric vehicles. However, it appears that automakers did not constrain the manufacturing of electric vehicles as much as internal-combustion-engine vehicles, which supported a 108% year-over-year growth in EV sales. In addition to government-backed regulations, high fuel costs and financial incentives supported strong growth in electric vehicle sales in 2021, especially in China and the European Union. While prevailing drivers of EV growth in 2021 will continue in 2022, S&P Global Platts Analytics expects an acceleration in EV sales growth this year, advanced by actions taken by automakers themselves. Automakers continue to increase investments in EV manufacturing and battery technology, offering a broader range of EV models and greater buildout of charging stations. EV adoption will increasingly shift from policy/subsidies to producer and consumer choice. S&P Global Platts Analytics forecasts EV sales will grow more than 40% year over year in 2022.

Gap between hydrogen production ambition and reality will be tested

Ambition surrounding hydrogen development was in the spotlight last year, with announced projects of low-carbon hydrogen production capacity in Platts Analytics’ Hydrogen Production Assets Database swelling to 29 million tons by the end of 2021. Project announcements have been underpinned by a growing list of national hydrogen strategies worldwide, which provided ambitious targets and incentive structures for new production capacity. While the achievability of even near-term hydrogen production targets (example: the EU’s target of 6 GW of green hydrogen production capacity by 2024) will not be determined fully in 2022 alone, developers would benefit if they can show that projects can be completed on time and on budget in 2022. Production capacity across several different hydrogen production pathways is slated to become operational in 2022, ranging from a larger-scale project using biogas and landfill gas, to small scale electrolyzers paired with renewables. However, S&P Global Platts Analytics does not expect large-scale blue hydrogen (natural gas + carbon capture) projects to become operational in 2022, but it will closely monitor, as a key signpost of the viability of blue hydrogen projects, the development and policy support of carbon capture projects that are not associated with hydrogen production this year.

Technology milestones in 2022 to point the way forward in the energy transition

Perhaps the greatest challenge of the energy transition is moving beyond the increase of wind and solar generation and electric vehicles, to reducing emissions in sectors that are more difficult to decarbonize, such as aviation and marine transport. While needle-moving technologies in these sectors are essentially still in the demonstration phase, several milestones look to be achieved over the next 12 months, including a pair of hydrogen-fueled maritime vessels hitting the water, and eight ships that will be “ammonia ready” as an alternative fuel if/when the supply and infrastructure is available. While not powered by hydrogen itself, the first large liquefied hydrogen (LH2) carrier will load its first cargo of hydrogen in Australia in early 2022, an early indication that international hydrogen trade can be viable. In aviation, S&P Global Platts Analytics anticipates greater use of sustainable aviation fuels (SAFs), driven by government mandates (e.g., France’s mandate of 1% SAF usage beginning in 2022) and commercial airlines looking to test higher SAF blend rates (following the lead of United Airlines which achieved the feat on a commercial flight in December 2021). The change to the size of the orderbooks of ships and planes designed to use alternative fuels will be a key factor to watch in 2022.

Dan Klein, Head of Energy Pathways, Analytics, S&P Global Platts, said: “With oil and gas prices high and on the rise at year’s launch, policymakers are again grappling with how to balance the twin desires of encouraging affordable energy and reducing greenhouse gas emissions. The fact that consumers are paying more for energy at the same time emissions are rising to new record highs underscores the pressures of urgency around energy transition acceleration.”