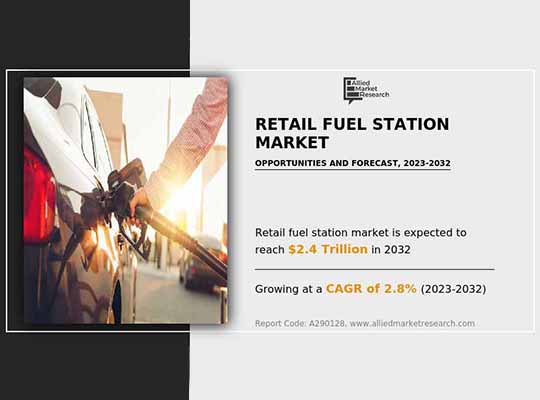

According to a new report published by Allied Market Research, the retail fuel station market size was valued at $1.8 trillion in 2022, and is estimated to reach $2350.6 billion by 2032, growing at a CAGR of 2.8% from 2023 to 2032.

Retail fuel stations, known as gas stations or petrol stations, are facilities where motorists can purchase gasoline (petrol), diesel, and other fuels for vehicles. These stations provide various services and amenities catering to the needs of drivers.

The major companies profiled in this report include Exxon Mobil Corporation, Reliance Industries Limited, BP p.l.c., Total Energies SE, Shell plc, Indian Oil Corporation Limited, Phillips 66, TAQA, ENOC Company and Gulf Oil International.

Increase in demand for passenger and commercial vehicles, rise in disposable income, and rapid urbanization, propels retail fuel stations market growth. In addition, the thriving transportation industry has escalated the sale of buses, trucks, and cars, further pushing the retail fuel stations market growth. Furthermore, fuel stations have used modern payment systems such as QR codes and credit/debit cards options to increase flexibility and attract more customers.

New-era fuel stations have convenience stores where consumers can purchase items such as food and travel items, further encouraging customers to visit the retail fuel stations. Moreover, the rise in standards of fuel stations across emerging economies is further improving the market dynamics.

Petrol, as a primary fuel source plays a pivotal role in driving the retail fuel station market. The high dependency on petrol for transportation fuels and industrial purposes positions it as a key determinant in the growth and dynamics of retail fuel stations market. The widespread use of petrol-powered vehicles and machinery across globe underscores the critical importance of petrol availability, pricing, and distribution networks established through retail fuel stations.

Petrol is one of the most widely used fuels globally for transportation due to its energy density, ease of use, and suitability for internal combustion engines. Its availability and usage vary across regions, with different fuel standards and regulations governing its composition and sale. Furthermore, rise in consumers preference for contactless payment methods due to their ease of use and perceived security drive the retail fuel stations market.

The global automotive industry is witnessing geographical shifts in production, sales, and demand. Emerging economies, particularly in Asia-Pacific, have become major automotive markets, driven by rising incomes, urbanization, and increasing consumer demand. India now ranks as the third largest car market in the world. However, traditional automotive powerhouses in the U.S., Europe, and Japan continue to innovate and invest in new technologies to maintain their competitive edge.

In North America, a decline in car sales by 6.7% and 2.4% in Western Europe due to Russia-Ukraine war. However, there was an increase in demand in the Asia-Pacific region (+2.4%), drive retail fuel stations market. Globally the supply chain issues and rising prices, coupled with the demand crisis due to the macroeconomic conditions, the automotive industry struggled, electric vehicles and hybrid vehicles have seen a growth in sales. In 2022, electric vehicle sales grew by 60.8% worldwide.

Privately-owned fuel stations play a pivotal role in driving the retail fuel station market due to their adaptability, innovation, and competitive edge. These stations, often operating as independent entities or within franchise networks, contribute significantly to the market’s dynamism. Moreover, private owners often foster a culture of innovation, constantly seeking ways to enhance operational efficiency and customer experience. Furthermore, private players invest in eco-friendly practices, such as installing electric vehicle charging stations, offer alternative fuels, aligning with the growing environmental consciousness among consumers.

The government continuously works on to improve the quality of fuel and to increase the number of fuel stations in the country. Lower fuel prices generally stimulate increased consumer demand for gasoline and diesel. Cheaper fuel encourages more driving and attract customers who were previously limiting their driving due to higher costs. This increased demand can positively impact retail fuel station sales. Lower oil prices can free up capital for fuel station operators, enabling them to invest in infrastructure improvements, expansions, or additional services to enhance its offerings and serve customers.

However, it is essential to note that the relationship between declining oil prices and the retail fuel station market varies on the basis of numerous factors, including geopolitical events, supply and demand dynamics, currency fluctuations, and government policies. These effects might be temporary or influenced by other market conditions while declining oil prices generally offer certain advantages to retail fuel stations.

Recent retail fuel stations market trends such as fuel pricing regulations, market modernization & investments, demand for alternative fuels, technology integration and regulatory changes create retail fuel stations market opportunities. Furthermore, fuel stations incorporate convenience stores, car services, and food outlets as part of their offerings. This diversification aims to increase revenue streams beyond fuel sales.

Moreover, growth in interest in alternative fuels and renewable energy sources drives retail fuel stations market. Some stations started offering compressed natural gas (CNG) and electric vehicle (EV) charging facilities. In summary, the future trends in the retail fuel station market forecast encompass the integration of EV infrastructure, technological advancements to enhance operations and customer experiences, and the evolution of stations into comprehensive lifestyle hubs, all of which will redefine the traditional retail fuel station model.

Investment choices may be impacted by political and regulatory uncertainty, which could impede the retail fuel stations industry expansion. The revenue and profitability of oil and gas activities are impacted by the continued volatility of oil prices. The future of retail fuel stations involves a blend of traditional fuel sales, innovation in services, sustainability practices, and adapting to the evolving needs and preferences of consumers in a rapidly changing automotive landscape. The retail fuel stations market size is expected to grow at a high CAGR from 2023 to 2040, driven by a number of factors, which include population growth, rise in incomes, increase in popularity of electric vehicles, and the growth in demand for sustainable fuels.

Source: https://www.alliedmarketresearch.com/retail-fuel-station-market-A290128