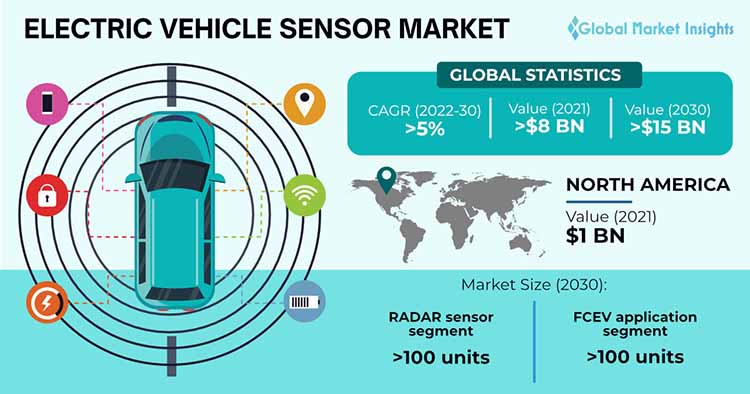

SELBYVILLE : The electric vehicle sensor market revenue is expected to cross a valuation of around USD 15 billion by 2030, according to latest research study by Global Market Insights Inc. The rising adoption of semi-autonomous and autonomous vehicles in the transportation and logistics sector will expedite the production of electric vehicle sensors. Many prominent players are integrating various sensors such as radar, image, LiDAR, and infrared sensors to optimize road safety and autonomous mobility. Growing concerns regarding the safety of autonomous technology have enabled governments worldwide to accept and adopt autonomous vehicles.

Multifaceted benefits of RADAR

The RADAR sensor segment is projected to reach more than 100 units by 2030. Radars offer multiple benefits such as signal propagation through multiple mediums such as clouds, fog, insulators, and snow. The rising demand for efficient object distance calculation and effective determination of target velocity will drive the growth of the radar electric vehicle sensor market. Changing preferences of manufacturers for component automation is further increasing the espousal of RADAR among OEMs.

Rising production of commercial vehicles to propel industry growth

The commercial vehicle sector is poised to register an appreciable assessment by 2030. The increasing demand for commercial vehicles across developed economies worldwide is primarily driving the EV sensor market from this industry. As per a study, the United States is the world’s largest market for commercial vehicles. In 2021, the country registered sales of almost 12.1 million units which account for 46.79% of the global sales of these vehicles.

Growing demand for fuel cell engines to escalate product sales

The FCEV application segment in electric vehicle sensor market is anticipated to reach above 100 units by 2030. This growth can be attributed to the various benefits of FCEVs such as operational flexibility, reduce gas emissions, development of renewable energy resources, and reduced greenhouse gas emissions. Supportive regulatory initiatives to bolster research and development activities will also have a major impact on the EV market growth.

Increasing deployment of PHEVs in North America

The North America electric vehicle sensor market accounted for USD 1 billion in 2021. The regional industry growth can be credited to the rising deployment of plug-in electric vehicles (PHEVs) and battery electric vehicles (BEVs) in the region. Major OEMs and government organizations are heavily investing in the modernization of existing automotive facilities to expand regional EV production, which will help augment EV sensor industry outlook.

Rising research and development activities to enhance market dynamics

Continental AG, Denso Corporation, Robert Bosch, Sensata, ZF, Valeo, Ampheol, Renesas, NXP Semiconductor, and Melexis are the key players operating in the electric vehicle sensor market. Most of these prominent players are developing innovative technologies through extensive research and development activities to strengthen their business position. For instance, In June 2021, Infineon Technologies AG develops new 60 GHz radar sensors for short-range automotive applications.

Chapter 2 Executive Summary

2.1 Electric vehicle sensor industry 3600 snapshots, 2018-2030

2.2 Business trends

2.3 Regional trends

2.4 Product trends

2.5 Vehicle type trends

2.6 Application trends

Chapter 3 Electric Vehicle Sensor Industry Insights

3.1 Introduction

3.2 COVID-19 impact

3.3 Russia-Ukraine war impact

3.4 Electric vehicle sensor industry ecosystem analysis

3.5 Technology & innovation landscape

3.6 Regulatory landscape

3.7 Industry impact forces

3.7.1 Growth drivers

3.7.1.1 Rising government regulations and initiatives in North America and Europe

3.7.1.2 Increasing demand for hybrid and electrical vehicles globally

3.7.1.3 Growing innovation in ADAS systems for EVs

3.7.1.4 Proliferation of EV component manufacturers in Asia Pacific

3.7.1.5 Growing awareness towards sustainable mobility

3.7.2 Industry pitfalls & challenges

3.7.2.1 High cost associated with LiDAR sensors

3.8 Investment portfolio

3.9 Growth potential analysis

3.10 Porter’s analysis

3.11 PESTEL analysis