Discoms are the weakest link in the entire value chain of the Indian electricity sector. Their inability to pay generators on time, manage their losses and improve on other inefficiencies weighs down the entire power sector. Discoms in India have been functioning sub-optimally and have even been described as a “leaking bucket”, due to their inability to break-even despite multiple financial bailouts over the years.

In 2015, Ujwal DISCOM Assurance Yojana (UDAY) was launched by the government wherein financial and technical targets were given to the states. The states took over 75 percent of the debt of the Discoms and issued bonds that were subscribed to by banks and financial institutions. Five years since the scheme was launched, the condition of Discoms have remained the same- debt-ridden.

The government, in May 2020 announced liquidity infusion to the extent of INR 900 billion through Power Finance Corporation and Rural Electrification Corporation (PFC-REC) to help cash strapped Discoms pay their dues till March 2020. Now, the government is set to hike this to INR 1,200 billion to help discoms pay their outstanding bills until June 2020. Though this move has been welcomed by various stakeholders, it does not provide a long- term solution.

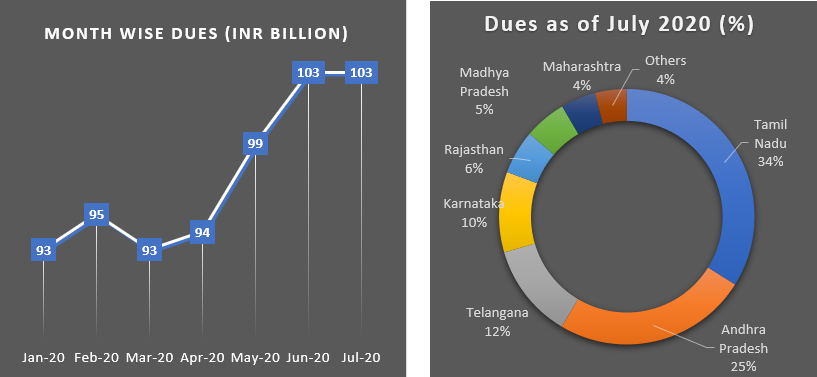

According to PRAAPTI portal, the overdue of conventional generators amounts to Rs 106,500 crore in July 2020 whereas Rs 10300 crore is overdue to non-conventional generators. Infusion of one time-liquidity cannot ensure the improved effectiveness of Discoms in the longer run. Several past instances of liquidity infusion have done little good to improve the financial health of Discoms.

Figure 1: Overdue amount to RE generators

As can be seen from the above graph, the RE rich states like Tamil Nadu, Andhra Pradesh, and Telangana account for ~81 percent of the total outstanding dues from Discoms to RE generators.

The outstanding amount to the renewable generators can fade away their confidence in Discom’s ability to payback and as a result they may look beyond the discoms to sell their power in open market. Piling overdues and payment delays can render the renewable projects unviable, which are already facing other risks such as tariff renegotiation, which may deter lenders cautious about committing funds to such projects, potentially driving up the finance cost. This vicious cycle can seriously hurt the renewable sector.

The major problem with Discoms despite various steps taken is- revenue deficit. The cost of power procured by Discom is generally higher than the tariff charged to consumers. The main causes for this are-

- Technical losses during the transmission and less average revenue realised due to lack of effective billing procedures,

- Lack of proper recording of the consumption of power and power theft.

- The tariff structure is also not rationalised, where commercial and industrial (C&I) consumers bear the brunt of cross-subsidy of residential and agriculture segments.

These inherent flaws plague the Discoms, thereby rendering them unsustainable. Unless the underlying issues are addressed with the support of central and various state governments and necessary reforms are bought in, we might need another bailout package soon.