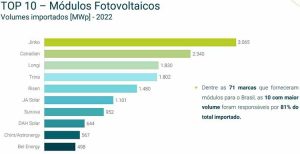

According to Greener’s Distributed Generation Strategic Study, Jinko Solar was the leader for PV modules volume imported in Brazil last year with 3,065 MWp imported, confirming once again its lead in the Brazilian solar PV market.

As a result, Jinkosolar is expected to surpass a market share of 17.6% in Brazil for the first time. This marks a significant achievement for the solar module manufacturer as it continues to gain market share despite more brands hitting the market.

About this success, Alberto Cuter, General Manager for Latin America and Italy commented, “The excellent result obtained in 2022 gave us further motivation to continue investing in the country. Over 60% of sales are related to the new Tiger NEO, demonstrating that the Brazilian market is very attentive to products quality. And this keeps us positive towards a further strengthening of Jinko’s market share in 2023” and continues “I really want to thanks all our brazilian partners who contributes to this incredible success promoting JinkoSolar high quality products”.

JinkoSolar entered in the Brazilian Market in 2012 seeing from the very first stag, the potential of this big market and understanding since the beginning the necessity to establish a local team. These huge results and achievements are now the results of all the past choices we did, never stop believing in the potentiality of this country, but also the results of the strong and faithful relationship we built together with our main partner both in Utility and in DG segments and for sure, in the last year, the launch of the N-type Topcon Tiger Neo Modules that have thrilled the market.

At present, we are accompanying this growth with an ever-growing team that not only operates in sales, but also operates in the technical, logistics, marketing and operations services.

Among the 71 brands that supplied solar panels to Brazil in 2022, the 10 with the highest volume were responsible for 81% of the total imported. In addition, the consultancy pointed out that the volume of modules demanded by the Brazilian market in 2022 to meet solar generation exceeded 17 GW, up 73% compared to 2021 (10.3 GW).

In total, according to the survey, investments in excess of R$ 64 billion were made possible for both DG (distributed generation) and GC (centralized generation).