WILMINGTON, DE, UNITED STATES – According to a new report published by Allied Market Research, titled, “Electric Vehicle Charger Market Size, Share, Competitive Landscape and Trend Analysis Report, by Vehicle Type, by End User, by Charging Type : Global Opportunity Analysis and Industry Forecast, 2023-2032”.

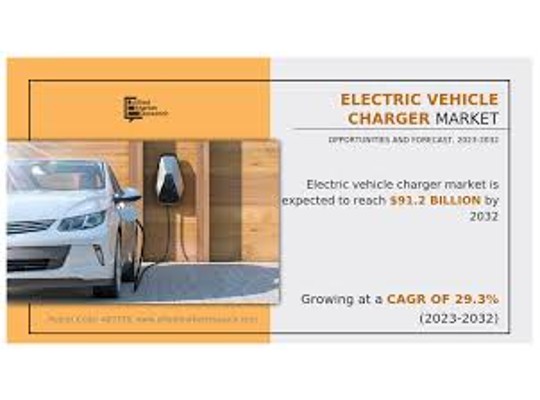

The global electric vehicle charger market size was valued at $7.2 billion in 2022, and is projected to reach $91.2 billion by 2032, growing at a CAGR of 29.3% from 2023 to 2032.

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 :

Chargemaster

Chroma ATE Inc,

Delphi Technologies,

Robert Bosch GmbH

AeroVironment, Inc.

Schaffner Holding AG

Pod Point

ABB

Siemens

ChargePoint, Inc.

𝐊𝐞𝐲 𝐅𝐢𝐧𝐝𝐢𝐧𝐠𝐬 𝐎𝐟 𝐓𝐡𝐞 𝐒𝐭𝐮𝐝𝐲 :

By vehicle type, the hybrid electric vehicle segment is anticipated to exhibit significant growth in the near future.

By end user, the commercial segment is anticipated to exhibit significant growth in the near future.

By charging type, the off-board chargers segment is anticipated to exhibit significant growth in the near future.

By region, North America is anticipated to register the highest CAGR during the forecast period.

The electric vehicle charger market is expected to experience significant growth owing to advancements in charging systems such as high-power charging, ultra-fast chargers, and wireless charging. North America includes the U.S., Canada, and Mexico. The market is expected to grow in North America during the forecast period as the governments in various countries across the region, including U.S. and Canada, implement policies and incentives to support the adoption of electric vehicles and the development of charging infrastructure.

There is a rise in the significant investments made by major electric vehicles (EV) and battery makers in EV supply chains in North America that leads to an increase in the production and sales of electric vehicles, which in turn is anticipated to drive the demand for electric vehicle chargers. For instance, according to International Energy Agency (IEA), between August 2022, and March 2023, major electric vehicle and battery manufacturers announced investments of at least $52 billion in North American EV supply chains.

There is an increase in the demand for EV chargers by the U.S. government, setting standards for their production, which is expected to stimulate investment and innovation in the electric vehicle charger industry. For instance, in February 2023, Biden-Harris Administration in the U.S. announced a new set of standards and goals for a “Made in America” national network of electric vehicle (EV) chargers. The plan includes an increase in the number of EV chargers available throughout the country to improve the overall infrastructure for EVs. Moreover, the plan includes the installation of over 500,000 EV chargers across the U.S. by 2030. Such developments create new opportunities for companies that manufacture electric vehicle chargers, which in turn drives the growth of the market.

The electric vehicle charger market in Canada experiences steady growth as electric vehicle adoption continues to increase in the country. Moreover, the Canada government has taken steps to support the growth of the EV charger market. For instance, in February 2023, the Canada government announced funding of up to $1.5 billion over five years to build 2,400 electric vehicle charging stations through the Electric Vehicle Infrastructure Demonstration. The increased investment in charging infrastructure leads to greater adoption of electric vehicles, which in turn is expected to drive the market as demand for charging equipment continues to grow.

The rise in the involvement of major automobile and charging infrastructure providers in the installation of charging stations is expected to bring significant opportunities for the growth of the market. For instance, in January 2023, BMW Group Mexico and Evergo announced their plan to install 4,000 electric vehicle chargers in Mexico. The installation of these charging stations is a part of the Electrify Mexico initiative that aims to promote sustainable mobility and encourage the adoption of electric vehicles. Such developments increase the convenience and accessibility of charging for electric vehicle owners and thus drive the growth of the market.

On the basis of end user, the global electric vehicle charger market is segmented into residential, and commercial. Residential charging includes level 1 electric vehicle supply equipment (EVSE) and level 2 EVSE mode of charging. Level 1 EVSE provides charging through a 120 V AC plug, which adds about 2–5 miles of range to a vehicle per hour of charging time, making it suitable for the plug-in hybrid electric vehicle. Furthermore, level 2 EVSE provides charging through a 240 V AC plug. Level 2 adds about 10–60 miles of range to a vehicle per hour of charging time, making it suitable for all EVs.

Residential chargers provide EV owners with convenience and cost savings. There is a rise in demand for residential chargers as they charge electric vehicles faster. Manufacturers develop strategies to meet the surge in demand for EV charging systems with the rapid expansion of the electric vehicle market. For instance, in September 2021, Wallbox, a leading provider of electric vehicle (EV) charging solutions, plans to establish its first manufacturing facility for EV charging systems in Arlington, Texas, in the United States. The new manufacturing facility is expected to serve as the production hub of Wallbox for its EV charging systems such as residential chargers Pulsar Plus AC chargers of Wallbox. Such developments to meet the rise in demand for residential and commercial EV charging infrastructure are expected to drive the growth of the segment in the market.

Commercial charging offers charging solutions for a wide variety of commercial properties, including airports, universities, hotels, offices, retail, hospitality, and industrial businesses. Commercial chargers offer multi-unit dwellings, which allow multi-users to charge their vehicles simultaneously. Such chargers provide all modes of charging such as both AC and DC. Commercial chargers are designed to cater to the needs of businesses, fleet operators, and public charging stations. Commercial chargers provide faster charging speeds, ensuring efficient and rapid charging for multiple electric vehicles.

Various power solution companies aim to develop commercial and other application chargers to contribute to reducing carbon emissions by providing clean and efficient power alternatives. For instance, in January 2023, Aispex, a company specializing in power solutions, unveiled a range of new products at the Consumer Electronics Show in Las Vegas. The new products include AC Level 2 commercial chargers and other mobile and portable chargers. Moreover, the development of commercial chargers with higher power outputs to enable ultra-fast charging is expected to drive the growth of the segment in the market.

𝐂𝐎𝐕𝐈𝐃-𝟏𝟗 𝐈𝐦𝐩𝐚𝐜𝐭 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬 :

The global supply chains were disrupted, and the manufacturing and distribution of electric vehicle chargers were halted due to the outbreak of COVID-19. However, post-pandemic, the EV charger market witnessed advancements in EV charger technology, including faster charging capabilities, improved connectivity, and enhanced user experience. Innovations such as wireless charging and smart grid integration gained momentum, which further drive the market recovery.