Energy storage technologies have undergone several years of sustained growth stemming from progress in markets such as consumer devices and the quest for decarbonization kick-starting growth in electric vehicle (EV) and stationary energy storage demand. A diverse range of applications calls for a diverse range of energy storage technologies, and many questions remain, such as which technologies are best suited to which application, what are the alternatives to lithium-ion, or how will battery performance and cost continue to improve?

Businesses with interests in the storage of mechanical, electrochemical, chemical, electrical, and thermal energies are now beginning to emerge. The opportunities and challenges they face have been documented in a range of IDTechEx reports during the year.

The status of energy storage markets

The term ‘energy storage’ covers technologies that range from lithium-ion, solid-state, sodium-ion, sodium-sulphur, and redox flow batteries (RFB), through to supercapacitors and flywheels, or hydropower and compressed air energy storage (CAES).

For stationary markets, RFBs based on vanadium or zinc are being deployed, while various other flow battery chemistries are also being developed further. However, the stationary market is not reliant on electrochemical storage, with solutions such as compressed air and various forms of gravitational storage being discussed for long-duration (>4h) applications.

For smaller form-factor batteries, the growth in IoT and wearables offers an opportunity for different battery chemistries and form factors, including thin-film and flexible batteries. And of course, Li-ion battery technology, the incumbent for consumer devices, EVs, and new stationary storage, is still evolving. State-of-the-art solutions such as NMC 622 and NCA cathodes are likely to give way to NCMA or NMC 811 or single-crystal variants, graphite-based anodes may be replaced by lithium-metal or silicon, while liquid electrolytes will continue to incorporate new additives or be replaced entirely by solid electrolytes.

Currently, the broad energy storage market can be sub-divided into storage types that are: at a formative or exploratory stage; emerging (such as flexible and printed batteries or compressed air energy storage); and established and consolidated (e.g. EV batteries and some grid-level energy storage systems). There is a huge variety within these groups in terms of the technology, application, form factor, mechanical properties, and materials used in their energy storage solutions.

Energy storage: constant challenges vs. huge potential

For sectors such as stationary storage or EVs, regulation and government support play a key role, with the potential to both stifle and encourage growth. There are challenges inherent in the sector, such as the constant trade-off between the existing capabilities of energy storage technologies and the demands they are required to meet. For example, while current lithium-ion battery technology, and some supportive regulations, have allowed EVs to become part of the mainstream discussion for transport decarbonization, they still constitute a tiny portion of the total on-road transport market. Improvements to battery performance are still required. One option for this comes from solid-state batteries utilizing lithium metal anodes, which offer the possibility for improved safety and greater energy density. However, challenges remain for the deployment of large solid-state batteries at scale.

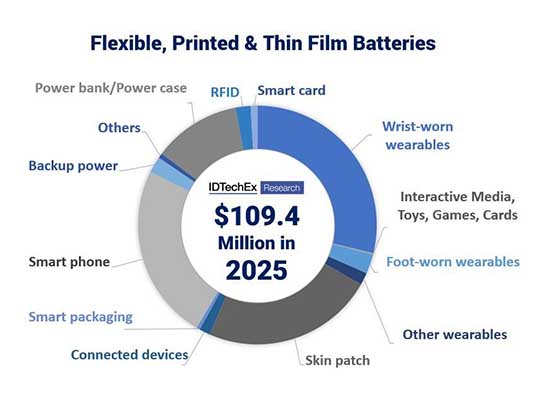

While the widespread use of solid-state electrolytes for automotive batteries is still some years away, they have already found commercial use in other sectors, such as medical devices. Solid-state electrolytes can also be used in flexible, printed, and thin-film batteries in applications such as wearables or skin patches, demonstrating potential growth applications for batteries outside the widely discussed stationary and EV markets. Figure 1 shows how sector demand will drive the development and application of flexible, printed, and thin-film batteries.

Energy storage forms to watch

During 2020, IDTechEx has analyzed and reported on a range of technologies within the energy storage sector and their associated markets. For example:

- Solid state – the move from sulphide to inorganic solid-state electrolyte; value propositions and limitations; the state of the market and key players.

- Lithium-ion – market demands; anode/cathode materials and capabilities; sources of improvement (e.g. energy density/life-cycle/charge-rate/cost); patents.

- Supercapacitors – development goals; questions to be answered (life cycle, safety, temperature stability, voltage/discharge profiles; cost); the pursuit of 100 Wh/kg supercapacitors and the issues involved; new markets generated by technology.

- Redox flow batteries – technical and market aspects; advantages vs. disadvantages of various chemistry options; market forecasts, challenges, and opportunities; Vanadium technology vs. emerging alternatives (e.g. Zinc/Bromine, Fe-RFB, Zinc/Air, Hydrogen/Bromine).

Other key concerns reported on include

- The hydrogen economy – the multiple types of fuel cell; regional analyses; hydrogen production methods; types of electrolyzer; key market players.

- Recycling – particularly around Lithium-ion batteries, looming increase in end-of-life batteries; regulatory control; supply chain issues; recycling processes; cathode recycling values.

- Potential/emerging energy storage technologies – compressed air energy storage (CAES); liquified air energy storage (LAES); gravitational energy storage (GES); thermal energy storage; technical aspects; key market players.

Looking ahead

Energy storage technologies are fundamental to an increasingly connected and green world. Keeping abreast of new technology developments, market trends, and growth opportunities across a range of energy storage options and applications will be key to those involved in the industry. To find out more, please explore IDTechEx’s 2020 range of reports on this sector.

For more information, contact visit www.IDTechEx.com.